Child maintenance law dictates that parents have a responsibility to provide financial support to their children, even if they do not provide the main day-to-day care for them.

The Child Maintenance Service (CMS) is a government-run service that arranges child maintenance payments and, if necessary, collects the payments from the paying parent and pays them to the receiving parent.

Continue reading for information from our family law team at Brown Turner Ross solicitors on what quantifies as financial child support, how much child maintenance is, and whether you are eligible to pay it.

Do you have to pay child support?

If you have a child who you do not provide the main day-to-day care for, and the child is either under the age of 16 or under the age of 20 if they are in education, then yes you will have to pay child support by way of weekly child maintenance payments.

The amount that these payments are is worked out based on the paying parent’s gross weekly income.

If the child’s father is not paying child support through child maintenance payments, then the mother can contact the Child Maintenance Service to enforce payments via a court order.

Before an application to the Child Maintenance Service is made, there will have to be contact with Child Maintenance Options. They will try and decide whether a family-based arrangement is possible before involving the CMS.

A family-based arrangement is one that is decided between paying parent and receiving parent, without any interference from the Child Maintenance Service. Payments through a family-based arrangement are not enforceable, and there is no supervision to ensure that payments are fair.

Therefore, our family law solicitors recommend that the Child Maintenance Service is involved to ensure that all parties are treated fairly and that the interests of the children are being considered.

What is classed as income for child maintenance?

The Child Maintenance Service will take a look at the paying parent’s income through data provided by the HMRC. Therefore, any income that the paying parent has declared to the HMRC for the most recent tax year will count as income when it comes to working out child maintenance payments.

Before this income is assigned a child maintenance rate, other incomes and expenses are taken into account such as benefits, pensions, or other children that the paying parent supports.

How is child maintenance calculated?

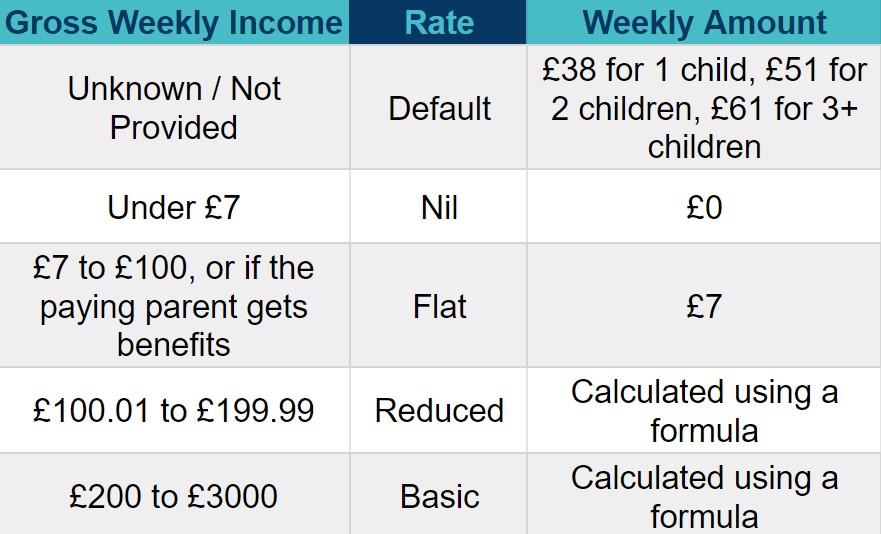

After identifying the paying parent’s gross annual income, it will be converted to gross weekly income before it is assigned a rate that dictates what child support payments will need to be made. There are a total of five different rates that may be assigned, as shown in our table:

If the paying parent’s gross weekly income is over £3000, then extra child maintenance payments can be arranged – although the receiving parent will have to make a court application.

The government has a basic child maintenance calculator, where you can input income details and any benefit details to get an estimated figure.

Reduced rate formula

The reduced rate formula applies to gross weekly income between £100.01 and £199.99.

An amount is deducted from any gross weekly income over £100 based on how many children the payments are being made for and how many children live with the paying parent.

Then £7 is added on to the amount, which is then rounded up to the nearest pound to leave you with your weekly child maintenance payment amounts.

Basic rate formula

The basic rate formula applies to gross weekly income between £200 and £3000.

An amount is deducted from any gross weekly income over £200 based on how many children currently live with the paying parent.

Then another percentage is deducted based on how many children the payments are being made for. This percentage is a different amount for income below and income above £800.

The amounts calculated are then added together and rounded up to the nearest pound, leaving leave you with your weekly child maintenance payment amounts.

Self-employed child maintenance calculator

On paper, someone who is self-employed should pay the same amount of child maintenance as an employee who earns the same gross annual income.

However, this becomes problematic if there are doubts over whether the paying parent is declaring all of their income, or where they have unearned income from property or dividends.

The Child Maintenance Service does have some control over including unearned income into the child maintenance payment formula, but it will need to be requested from the receiving parent.

Can CSA Claims be backdated in the UK?

Child maintenance payments can be backdated if the payments were ordered by the Child Maintenance Service.

The receiving parent will need to get in contact with the Child Maintenance Service who will then take control of collecting the payments, backdated to include any that were missed since

The issue arises when there have been informal, family-based arrangements for child maintenance. Because these are involuntary, the Child Maintenance Service cannot recoup costs for you. That is why it is important to formalise your child maintenance payments through the CMS as soon as possible after separating.

Conversely, the Child Maintenance Service can backdate payments to the paying parent if it is brought to light that they are not the parent of the child that the maintenance is being paid for, or if that child was no longer eligible for child maintenance yet payments were still made.

Do you pay maintenance with joint custody UK?

Yes, you will still have to make child support payments even if you have joint custody of your child, yet the child maintenance payments will be lower than if the receiving parent had sole custody of the child.

Joint custody child support is deducted based on how many nights over the course of a year the child spends with the paying parent. The deduction begins at 52 nights and decreases even further up to 175 nights.

Specific details on joint custody child maintenance payment deduction bands are as follows:

- 52 – 103 nights: reduced by 1/7th per child

- 104 – 155 nights: reduced by 2/7th per child

- 156 – 174 nights: reduced by 3/7th per child

- 175 nights or more nights: reduced by 50% per child plus a £7 a week deduction per child.

Child maintenance support at Brown Turner Ross

Whether you are a receiving parent who has not been receiving payments from your ex-partner, or you are a paying parent who feels the amount you are being asked to pay is unfair, then get in touch with our legal team at Brown Turner Ross and we would love to help you.

We understand that family matters can be incredibly complex, and will sit down with you over a no-obligation consultation to learn as much about your case as possible and identify ways that we can help.